How To Properly Assess AI Pharma Companies

The level of sophistication used in due diligence should be on a par with the level of complexity in a given industry. AI-Pharma companies are 100 times as complex as FinTech companies. Methodologies used to assess them should be 100 times as rigorous.

Discovering new drugs using AI is one of the most challenging areas in biological sciences. Top tier AI for Drug Discovery companies have distinguishing characteristics that include high levels of expertise in biopharmaceutical science, advanced proficiency in AI, very specialized teams, and constantly evolving internal knowledge. Companies in this sector are developing very advanced AI techniques that may enable them to produce the next blockbuster drugs, making them the new unicorns of the Pharma industry.

Due to the complexity, companies in this sector sometimes appear to be enigmatic black boxes to investors. Since most investment funds have not developed sufficiently robust methods to evaluate AI for Drug Discovery companies, they erroneously treat these companies as traditional biotech companies. There could be and should be better assessment methods for evaluating these companies. Even the most advanced companies should be scrutinized, and many parameters should be taken into account. Very few investment firms are capable of applying efficient due diligence to assess investment targets in this sector because they fail to use approaches that match the sophistication of the sector.

The Drug Discovery Environment

The drug discovery environment is big. It includes advanced AI for drug discovery teams, startups, pharma companies, venture investors, healthcare providers, and governments. Interactions in this environment are extremely inefficient. There are very few examples of high functioning relationships between AI startups, pharma companies and healthcare systems. Most of the venture investors are profiting on disproportions and inconsistencies in the sector, rather than through proactive adoption and use of the most advanced technologies available. This is why venture capital firms can generate profits without being sophisticated investors in this area. This scenario is far from ideal.

The pace of innovation in AI for Drug Discovery is unprecedented. These companies are using fundamentally different techniques than those used as standard practice 20 years ago. At the same time, the majority of investment funds are still using the same techniques that were used 20 years ago. The venture investment industry is not evolving at the pace required to match the rate of progress in DeepTech. The pace of progress in the investment technology industry must keep up with the pace of progress in advanced science and technology. Investment funds that leverage progressive techniques to update their business models, exit strategies, and underlying assessment methodologies, will have a big advantage over funds that don’t.

Specialized Metrics for Valuation and Forecasting

Although there are about 150 AI companies in the Drug Discovery space, very few of them are capable of building end-to-end solutions. Companies such as WuXi NextCODE, BenevolentAI, DeepMind Health, and Insilico Medicine are leaders in this area. Insilico Medicine was the first company to apply generative adversarial networks for generating new molecular structures with specified parameters and published a seminal peer-reviewed paper submitted in June 2016.

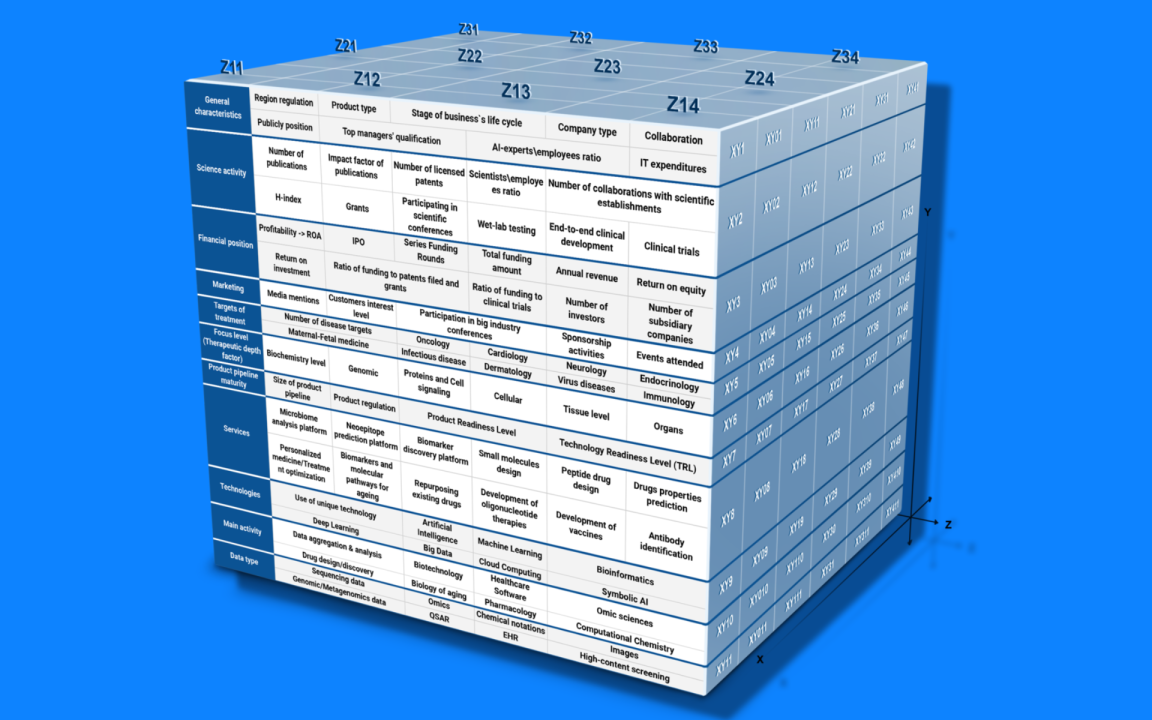

10 Fundamental Parameters

Early stage startups are assessed using 100 parameters. Advanced stage companies are assessed using more than 300 parameters.

1.Team Structure

The number of specialists and balance in the company’s team structure. Generally the best structure is 1/3 biochemistry specialists, 1/3 AI specialists, and 1/3 business development and investment relations experts, including former Pharma executives to assist in establishing contact and cooperation with Pharma companies. In practice what constitutes a sufficient number depends on the scope of the company’s target applications. As a general rule, the number of specialists should be more than 10. Top tier companies typically have a significant number of employees with expertise in AI/ML/DL, which allows generating unique know-how and intellectual property. These companies have strong interdisciplinary teams enabling collaboration between AI and life science experts.

2. Independent Scientific Validation

Evidence of independent scientific validation including a significant number of peer-reviewed papers in the domain of pharmaceutical research published in high-impact journals. Companies in this category demonstrate significant advances in the application of AI to drug discovery, which is reflected in a high number of research publications, public presentations, press-releases, and patents.

3. Thought Leadership and Active Participation in Conferences

Companies in this category typically participate actively in high profile public events, discussions, and forums. They appear in news and media regularly. They provide thought leadership and contribute significantly to promoting AI-driven approaches to drug discovery and basic biology, educating the public using specific use cases, and establishing best AI adoption practices. They usually have strong expertise both in drug discovery and development and in theoretical and practical aspects of AI technology, and have visibility within the scientific community through frequent presentations at scientific and technology conferences.

4. Direct Collaboration with Pharma and Tech Companies

The company should have direct collaboration with Pharma and Tech companies. This serves as additional validation that the company has something practical and tangible in its pipeline. The company should have official research collaborations with top 30 Pharma and Tech companies, where the company provides advanced know-how in AI-driven drug discovery.

5. AI Strength

There must be evidence that the company uses state-of-the-art AI techniques and consistently absorbs ongoing innovation in novel AI technologies and methodologies. If the company claims that it is an AI company, then it should be particularly strong in AI.

6. Investors

The company should have world-class investment funds as investors in their Series A or B rounds. There are fewer than 20 world-class investment funds recognized as being top funds globally by the entire investment community.

7. Target Molecules and Target Applications

The company should have a large number of target molecules discovered, and a sufficient number of molecules currently in clinical trials. Also taken into consideration is the number of target applications the company of pursuing (e.g. drug discovery, biomarker development, toxicity and ADME prediction, compound generation, compound binding, etc.).

8. Technology Development Scope

Whether the company is developing an end-to-end clinical pipeline, or focusing on just one particular segment in the overall drug discovery and development process.

9. R&D Depth

The proportion of the company’s funds dedicated to its R&D activities, as opposed to completing the development of products near the end of their development cycle. A high proportion of funds devoted to R&D indicates proactive innovation and new technology adoption.

10. Ratio of Investment to IP Produced

The ratio of the amount of money invested in the company to the amount of IP produced by the company. This is indicative of the performance of the company’s R&D activities and the company's future prospects, and reflects how intelligently and efficiently the company has utilized its funding to date.

Advanced Assessment Techniques

The business model traditionally used by venture funds has stagnated and will be ineffective going forward. To achieve success, investment firms operating in DeepTech industries will need advanced science and technology assessment techniques and new approaches to venture capital business models and exit strategies.

Investment in AI for Drug Discovery startups increased from $200 million in 2015 to over $700 million in 2018.

The number of AI for Drug Discovery companies increased by 20 companies.

The report shows 350 investors identified in Q1 2019, which is 30 more investors than Q4 2018.

There are 350 investment funds investing in the sector including Google Ventures, Tencent, Wuxi, Andreessen Horowitz, Khosla Ventures, and Sequoia Ventures.

Although there is no consensus so far among analysts regarding the expected valuation of the industry, estimates range from $5 billion to $20 billion by 2024.

Cost of R&D per drug is growing exponentially, but sales per asset are definitely not increasing.

An additional 10 new research centers were recorded since Q4 2018.

Regional proportion remained almost the same, despite an increased number of entities and a growing interest from China.

Declining R&D efficiency of Biopharma Companies remains a major concern among all parties in the industry with a continuous decline recorded during the last 8 years.

Demand for AI technologies and AI talent is growing in the Pharma and healthcare industries and driving the formation of a new interdisciplinary field — data-driven drug discovery/healthcare.

Subscribe and Comment

I'm interested in your feedback - please leave your comments. To subscribe please click subscribe at the top of this article.

Copyright © 2019 Margaretta Colangelo. All Rights Reserved.

This article was written by Margaretta Colangelo. Margaretta is a leading AI analyst who tracks significant milestones in AI in healthcare. She consults with AI healthcare companies and writes about some of the companies she consults with. Margaretta serves on the advisory board of the AI Precision Health Institute at the University of Hawaiʻi Cancer Center @realmargaretta

Thought leader in start-ups, AI drug discovery, generative AI, health-tech. Reimagining venture capital. Inspirational professor and public speaker. "Entrepreneur of the Year" twice. Made "Fast-50".

5yThis is a good summary article, but VCs do not behave the way you suggest they should. We at Cloud Pharmaceuticals meet all 10 criteria solidly, but most often find VCs viewing us as a biotech company. Also, the pharma collaborations are suspect. All of the players in this space have them, but it is not in itself a sustainable business model or an exit path unless the big pharma buys the AI company for the drug it produces. Those getting the most money are those with clinical stage assets. Some VCs are overpaying for generating data in expensive ways (the Craig Venter syndrome will backfire). Nicely done article, albeit a bit ahead of investor behavior.

Project Manager, PMI PMP

5yThe article is a perfect summary for selection of AI for drug discovery.

This is a very comprehensive post- nice work. It also aligns with what I’m seeing at recent Bio conferences. “AI drug discovery” talks and seminars are very popular and often standing room only.